Insurance Agent In Jefferson Ga - The Facts

Table of ContentsThe 6-Minute Rule for Insurance Agency In Jefferson GaWhat Does Business Insurance Agent In Jefferson Ga Mean?The Best Strategy To Use For Insurance Agent In Jefferson GaGetting My Insurance Agent In Jefferson Ga To Work

, the ordinary annual cost for a car insurance coverage plan in the United States in 2016 was $935. Insurance policy additionally helps you stay clear of the decline of your car.The insurance safeguards you and assists you with cases that others make against you in mishaps. The NCB may be supplied as a discount rate on the costs, making cars and truck insurance coverage a lot more inexpensive (Insurance Agent in Jefferson GA).

A number of elements influence the expenses: Age of the lorry: Oftentimes, an older car prices less to guarantee contrasted to a newer one. New automobiles have a greater market worth, so they cost even more to repair or change. Components are much easier to locate for older cars if repair services are required. Make and design of automobile: Some lorries cost more to guarantee than others.

Threat of theft. Particular lorries consistently make the regularly stolen checklists, so you could need to pay a higher premium if you own among these. When it involves automobile insurance, the 3 primary sorts of plans are obligation, accident, and detailed. Required responsibility protection pays for damages to another motorist's lorry.

Business Insurance Agent In Jefferson Ga Can Be Fun For Everyone

Some states call for vehicle drivers to lug this coverage (https://www.slideshare.net/jonportillo30549). Underinsured driver. Comparable to uninsured insurance coverage, this plan covers damages or injuries you sustain from a motorist who does not bring adequate insurance coverage. Motorbike protection: This is a plan specifically for bikes because automobile insurance coverage does not cover motorbike accidents. The benefits of car insurance policy far outweigh the threats as you can finish up paying hundreds of bucks out-of-pocket for an accident you cause.

It's typically much better to have more protection than not sufficient.

The Social Safety And Security and Supplemental Safety and security Earnings handicap programs are the biggest of several Federal programs that offer support to people with specials needs (Business Insurance Agent in Jefferson GA). While these two programs are different in numerous methods, both are provided by the Social Protection Administration and only individuals that have a handicap and fulfill clinical criteria might receive advantages under either program

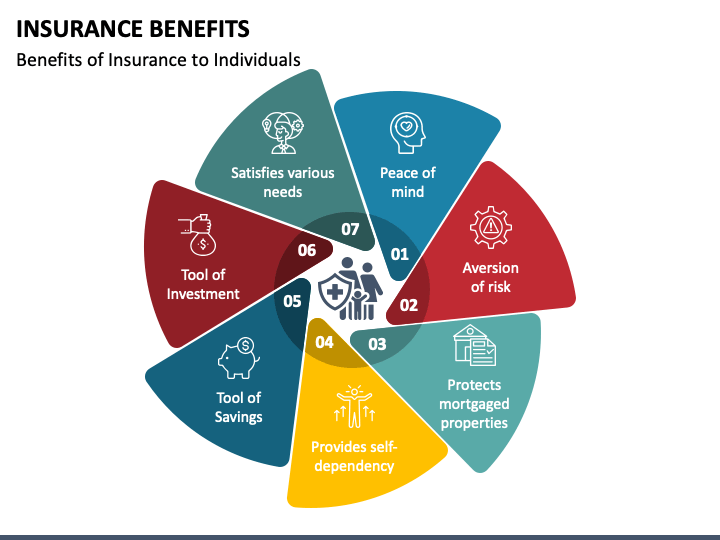

A subsequent analysis of workers' compensation claims and the extent to which absenteeism, spirits and hiring great employees were problems at these companies reveals the positive effects of using health and wellness insurance coverage. When compared to businesses that did not supply medical insurance, it shows up that using FOCUS resulted in renovations in the capability to hire excellent workers, reductions in the variety of workers' compensation claims and decreases in the level to which absenteeism and performance were issues for emphasis companies.

The Best Strategy To Use For Insurance Agent In Jefferson Ga

6 records have been released, including "Treatment Without Protection: Too Little, Far Too Late," which finds that working-age Americans without medical insurance are most likely to get insufficient healthcare and get it too late, be sicker and die faster and get poorer treatment when they are in the health center, even for severe circumstances like a car crash.

The study authors additionally keep in mind that expanding insurance coverage would likely lead to an increase in real source cost (despite who pays), since the uninsured obtain regarding half as much medical care as the independently insured. Wellness Matters published the research study online: "How Much Medical Care Do the Without Insurance Use, and That Pays For It? - Home Insurance Agent in Jefferson GA."

The duty of supplying insurance for staff members can be a challenging and occasionally costly job and lots of little businesses assume they can't afford it. What benefits or insurance coverage do you lawfully require to give?

Rumored Buzz on Insurance Agency In Jefferson Ga

Employee benefits generally begin with health insurance coverage and group term life insurance coverage. As part of the health insurance package, an employer may opt to offer both vision and oral insurance policy.

With the climbing pattern in the cost of medical insurance, it is affordable to ask employees to pay a percent of the coverage. Most businesses do put most of the cost on the employee when they offer accessibility to medical insurance. A retirement (such as a 401k, basic plan, SEP) is usually provided as a staff member benefit too - https://padlet.com/jonportillo30549_/alfa-insurance-jonathan-portillo-agency-3nc34q08f79xmvb4.